According to the U.S. Department of Agriculture (USDA), there are 153.7 million acres of farmland in Canada as of 2021. It is also one of the low-risk opportunities that is growing too fast. But is farmland a good investment? With help from experts like Darren & Tyler Sander, we are going to answer all of your questions.

So let's jump right in and see the beginner’s guide!

Why Is Farmland Gaining Attention Among Investors?

Farmland is one of the areas of interest because food is always needed. Let's be honest, people all over the world will keep eating, and farms supply them. That makes farmland a steady investment.

Unlike stocks that change fast, farmland values tend to climb over time.

In Canada, land prices rose by about 9–12 percent each year in 2022–24. Investors see it as a safe way to protect money from inflation.

Is Farmland a Good Investment?

Is farmland investment in Canada a good idea? Well, look at these numbers and then decide for yourself:

Over the past 10 years, Canadian farmland grew about 9.1 percent yearly on average.

In 2024, the value of the lands rose by about 9.3 percent. In 2023, it was 11.5 percent

For the long term, farmland will grow steadily with low ups and downs. One of the sources tracked 70 years and showed a 7.6 percent annual return with a few years of loss.

In Canada from 2000 to 2020, farmland prices rose by around 168 percent. And the rise was about 39 percent.

Buying Farmland as an Investment

If you want to buy farmland, then here are some steps that you can follow:

Find a realtor who knows farmland in the area you want.

Talk to your bank or a lender. Many banks offer up to 75 percent financing; in Canada, you can also go to Farm Credit Canada.

Use a lawyer from the same area where the land is; they will handle closing and checks.

Get an estimate to confirm land quality and nearby sales.

After you own the land, here's what you can do:

Farm it yourself, but it will require skill and time.

You can lease it under a fixed rent or share crops and income with a farmer.

Best Ways for Beginners to Invest in Farmland

You don't have to own a whole farmland. Here's what others do that you can try for your farmland investing:

REITs (Real Estate Investment Trusts): Companies buy farmland and pay interest.

ETFs or Stocks: You can buy shares in farming businesses or land firms.

Crowdfunding: Some websites will let you invest small amounts in farmland with others. You can earn rent or profit.

Farmland Funds: Some companies manage land investment and share returns. These might ask for big minimum investments.

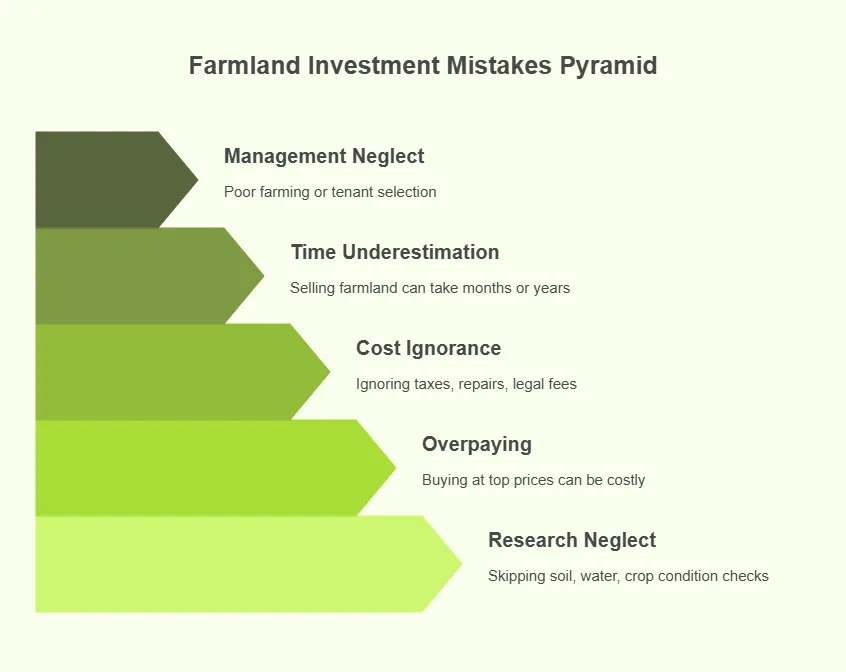

Common Mistakes New Farmland Investors Make

If you are a first-timer or even if you know the market, here are some common mistakes you should avoid:

Tips to Succeed as a First-Time Farmland Investor

If you are worried about farmland investment returns, then here are some tips:

Try to learn about local soil types and water resources.

You can talk to farmers and local experts.

You should always check past sale prices in the area.

Contact a trusted lawyer and agent.

Know what kind of lease fits you. Remember that fixed rent will keep things simple. On the other hand, crop share can earn more, but is riskier.

Try to visit the land as much as you can, or hire someone to care for it.

Watch interest rates and land market trends from trusted sources like the FCC.

Conclusion

Is farmland a good investment? Long story short- it will give you a steady income and rising land value. In Canada, land has grown about 9–12 percent yearly in recent years. So you can calculate the rest.

For a detailed overview, you should talk to a professional before investing. And if you have any other questions, then reach out to us!