189 million acres of farmland cover Canada. Interestingly, a good portion of this has been passed down through generations. Yes, Canada does not impose any direct inheritance tax. But the capital gains tax on your inherited farmland in Canada can hit hard. But if you stay prepared, it won’t matter.

That’s why we’ve created this guide to make you understand the rules so that you can plan ahead. This will help you preserve your family legacy.

What Is Inherited Farmland Tax?

In Canada, there is no formal inheritance tax. That does not mean that inheriting farmland will make it tax free. When someone passes away, the farmland is treated as if it were sold at fair market value.

This process is called deemed disposition and is carried out by the Canada Revenue Agency (CRA). This process can trigger capital gains tax, which the estate has to pay.

If you’re the heir, you will receive the land at the stepped up value. And if anyone decides to sell it later, they will be troubled with more tax issues.

The Tax Rules Around Inherited Farmland

When farmland is treated at fair market value upon someone’s death, the estate becomes responsible for paying the capital gains tax. This happens when the land value increases since purchase. Here, the beneficiary becomes an audience.

So, do you have to pay taxes on inherited farmland? Technically, yes. But, only indirectly.There is no inheritance tax. Only, the capital gains that arise from this deemed disposition. This can create a heavy financial burden on the estate and, ultimately, the heirs.

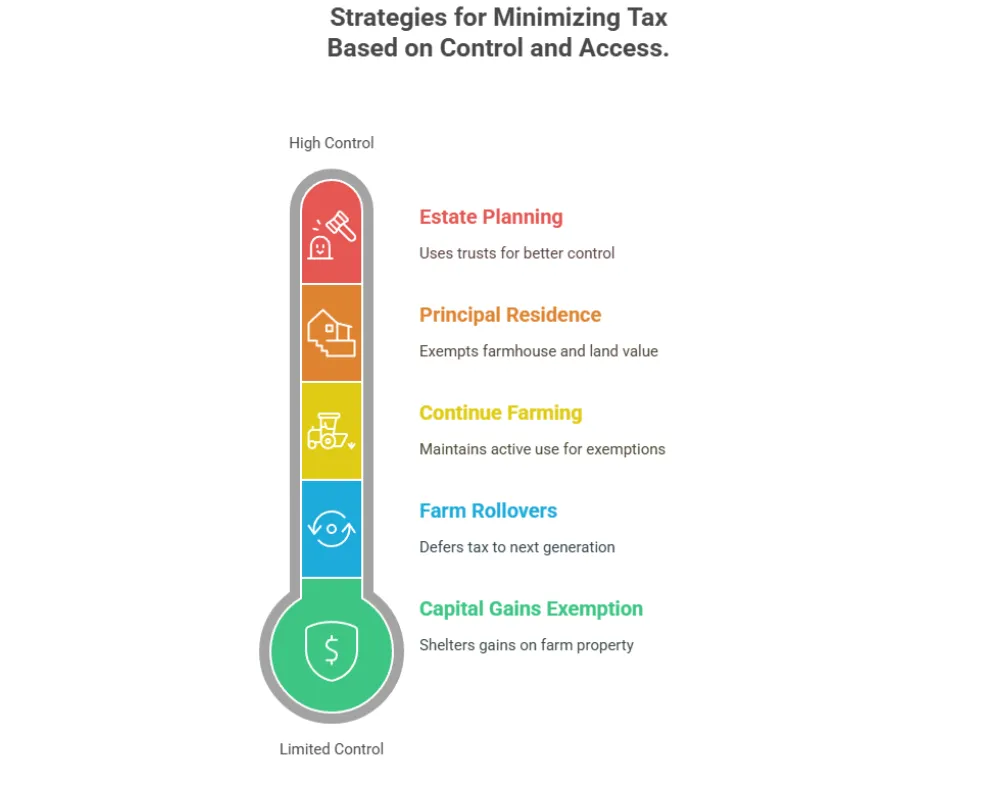

5 Key Strategies to Minimize Capital Gains Tax

If you want to minimize capital gains tax, here are some strategies for you to use:

1: Lifetime Capital Gains Exemption (LCGE)

One of the most effective ways to minimize the capital gains tax on inherited farmland is through the Lifetime Capital Gains Exemption (LCGE).

From 2025 on, this deduction lets you keep up to $1 million in capital gains. This is what happens when you sell or give away a qualified farm property (QFP) that you want to keep tax-free.

To qualify for the LCGE:

You need to have used the farmland principally in a farming business in Canada.

The business must have involved the deceased, their spouse, common-law partner, child, or parent for at least two years.

The owner must have been a Canadian resident during the year the property was transferred.

If your inherited property meets these conditions, you won’t owe any tax at all. This applies if the capital gain is less than the $1 million exemption.

2: Intergenerational Farm Rollovers

You can also decrease the inherited farmland capital gains tax through intergenerational rollover. Here, a child, grandchild, or great-grandchild receives suitable farm property while paying no taxes on it.

Even though the owner has died, the real estate deal does not result in cash gains. The land is instead given to the new owner at its changed cost base. This means that the tax won't be due until the next sale. And the next sale might not happen for decades.

To be eligible, the original owner or the family needs to have used the farm actively in a farming business. Renting out to others won’t be counted as active farming use.

3: Continue Farming

If you're inheriting the land and plan to keep it in the family business, you also qualify for tax benefits. If you just continue to farm and make sure it is being actively used as stated, you can claim the LCGE when you eventually sell.

This means you can avoid the tax implications of selling inherited farmland too soon or without proper planning.

4: Principal Residence Exemption

The fact that the house used to be on land that can be used for farming is good news. Because of the Principal Residence Exemption, some of the capital gains are not taxed in that case. In the end, this could help lower your tax bill.

And it was even more important if the house and the area around it were the deceased's main home. Don't forget that this provision only covers 0.5 hectares of land.

5: Smart Estate Planning

Planning a property estate is the smartest move when it comes to reducing capital gains tax on sale of inherited farmland.

This can be done through trusts, estate freezes, or structured lifetime transfers. You can sell or gift land during your lifetime. This way, you have more control, especially if you use strategies that take advantage of the LCGE.

You also need a professional’s help from someone like Darren and Tyler.

At A Glance: Strategies to Minimize Capital Gains Tax

Conclusion

Canada’s tax rules are quite complicated. But you can preserve your family’s farm and reduce taxes with the right plan. In Canada, there isn't a standard farmland inheritance tax, but there is still a capital gains tax that makes things harder.

So, is farmland free of inheritance tax? The answer is technically yes. But that doesn't mean you're off the hook. It’s important to speak with a tax advisor or estate planning specialist. A professional can help you apply the right strategies.